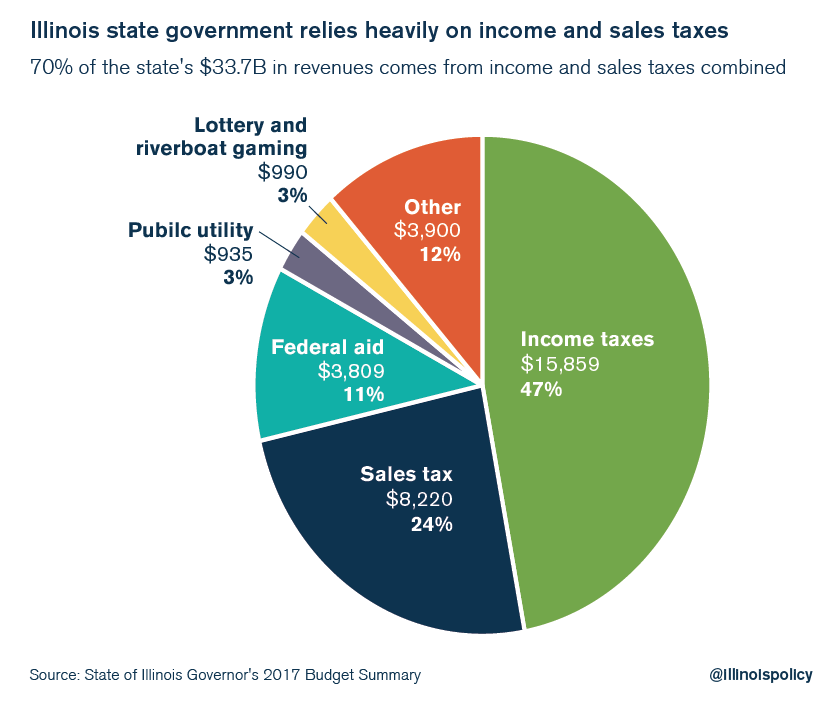

The Caucus Blog of the Illinois House Republicans: Calculating estimated state taxes during COVID-19 pandemic

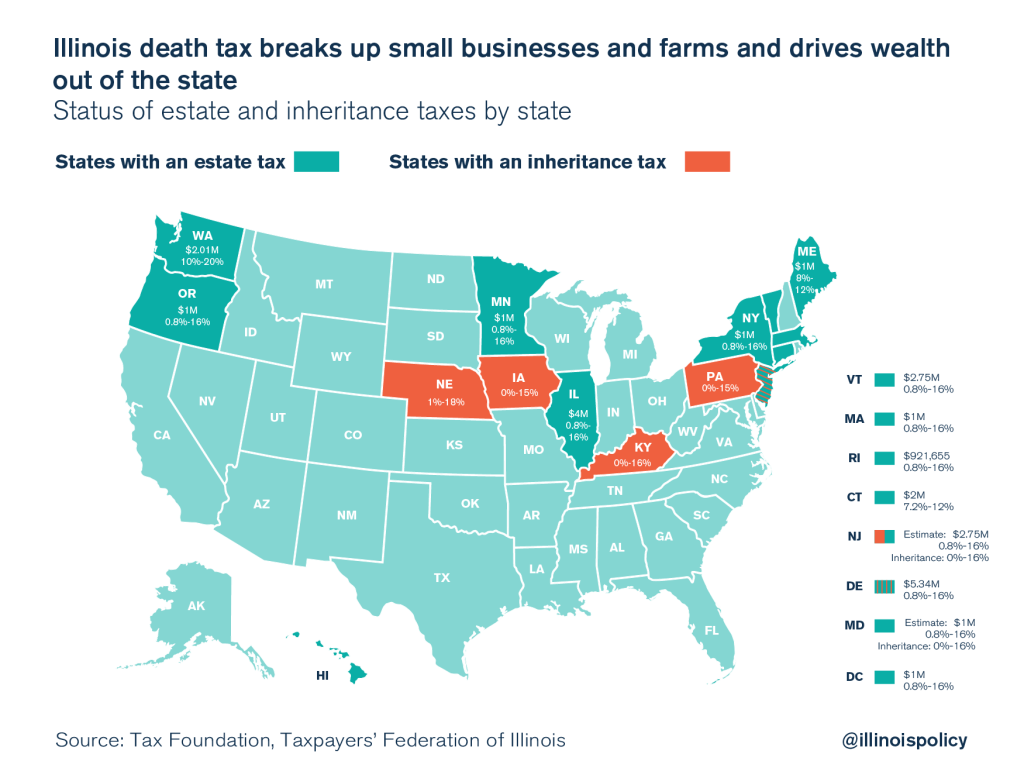

Illinois Estate Tax-Relationship to Federal Estate, Gift and GST Taxes, as well as The Relationship Between Forms 709, 706 and 1041 | Illinois Institute for Continuing Legal Education - IICLE

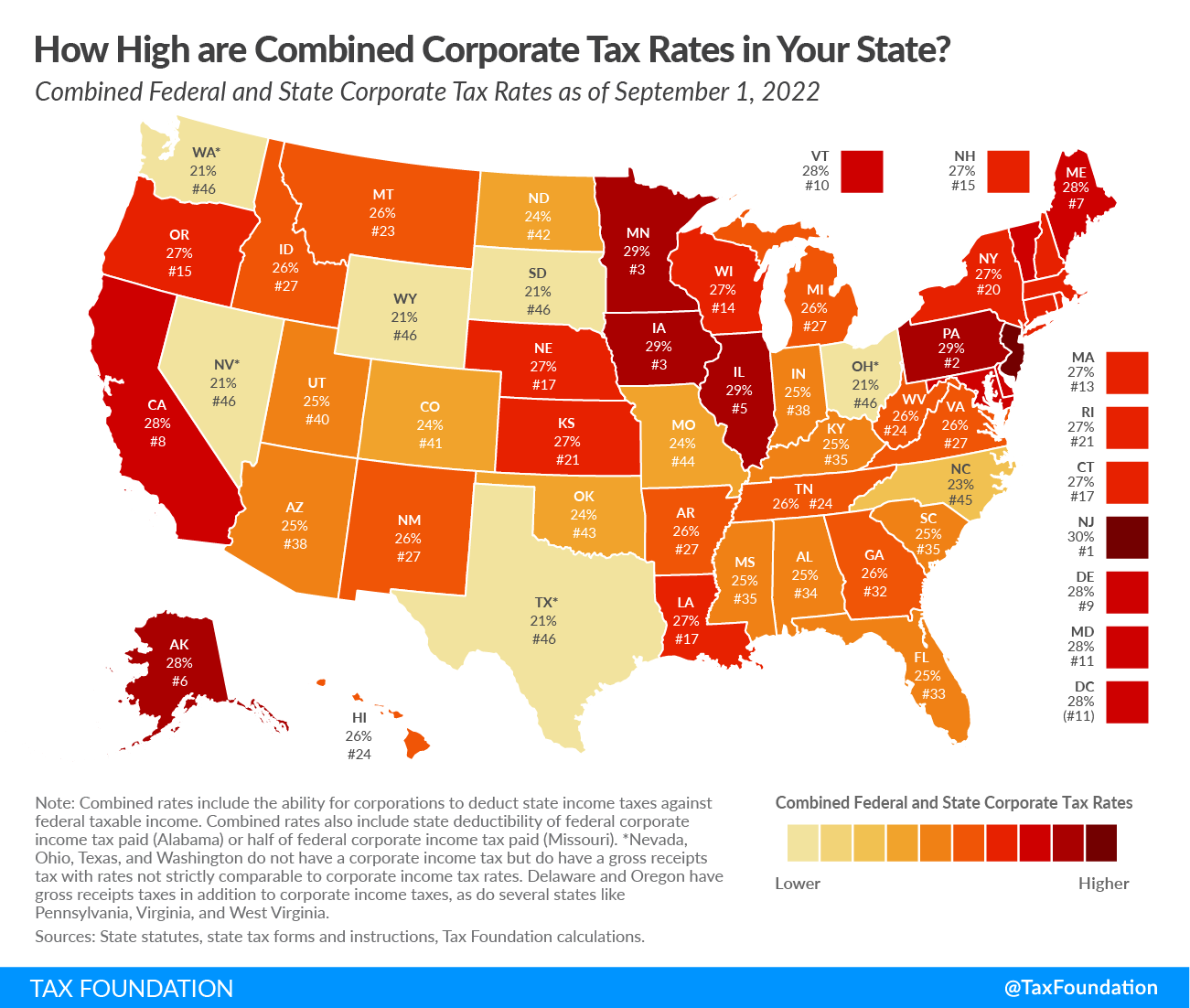

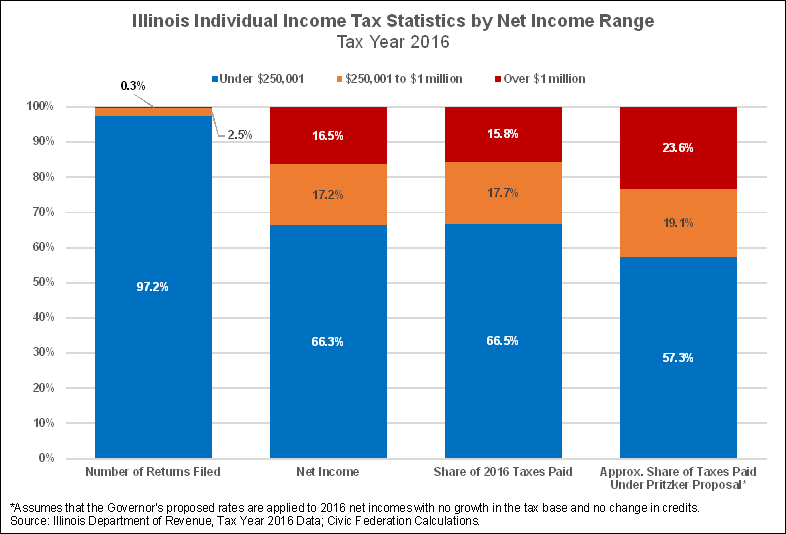

How Illinois' income tax stacks up nationally for earners making $100K - Center for Illinois Politics